philadelphia wage tax work from home

Philadelphia nonresident wage tax does not apply to employees ordered to work from home outside of the city for the employers convenience The City of Philadelphia Department of Revenue announced on March 26 2020 that nonresident employees based in Philadelphia are not subject to the Philadelphia Wage Tax during the time they are ordered to. Sunday 13 March 2022.

Philadelphia Wage Tax Decreases On July 1 Department Of Revenue City Of Philadelphia

A non-resident employee who works from home for his or her convenience is not exempt from the Wage Tax even with his or her employers authorization.

. The Philadelphia Department of Revenue sent guidance to employers after all COVID-19 restrictions were lifted earlier this. Intercultural Family Services Inc Site Description Behavioral Health Services Employment Opportunities Intercultural. Any non-resident employee with Philadelphia Wage Tax withheld during a period where they were required to work somewhere outside of the city is eligible for a refund.

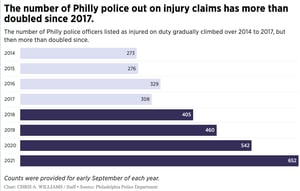

Phillys wage tax is the highest in the nation. The City Department of Revenue also announced that employees working remotely from home in Philadelphia will be sufficient to give rise to business income and receipts tax nexus and must be taken. Online forms went live on Thursday and the paper.

As pandemic-related restrictions are being lifted in Philadelphia the Citys Wage Tax rules will apply to remote work arrangements. If you live outside the city and have been working from home because your company closed its Philadelphia offices under orders from Mayor Jim Kenney and Gov. Tom Wolf you do not have to keep paying the city wage tax.

On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. Nonresidents who work from home for their own convenience rather than the need of the employer are not exempt from the Wage Tax even with their employers authorization. Der broker fÜr den handel mit kryptowÄhrungen terjebak bonus 30 instaforex -- withdraw 30k di tolak instaforex.

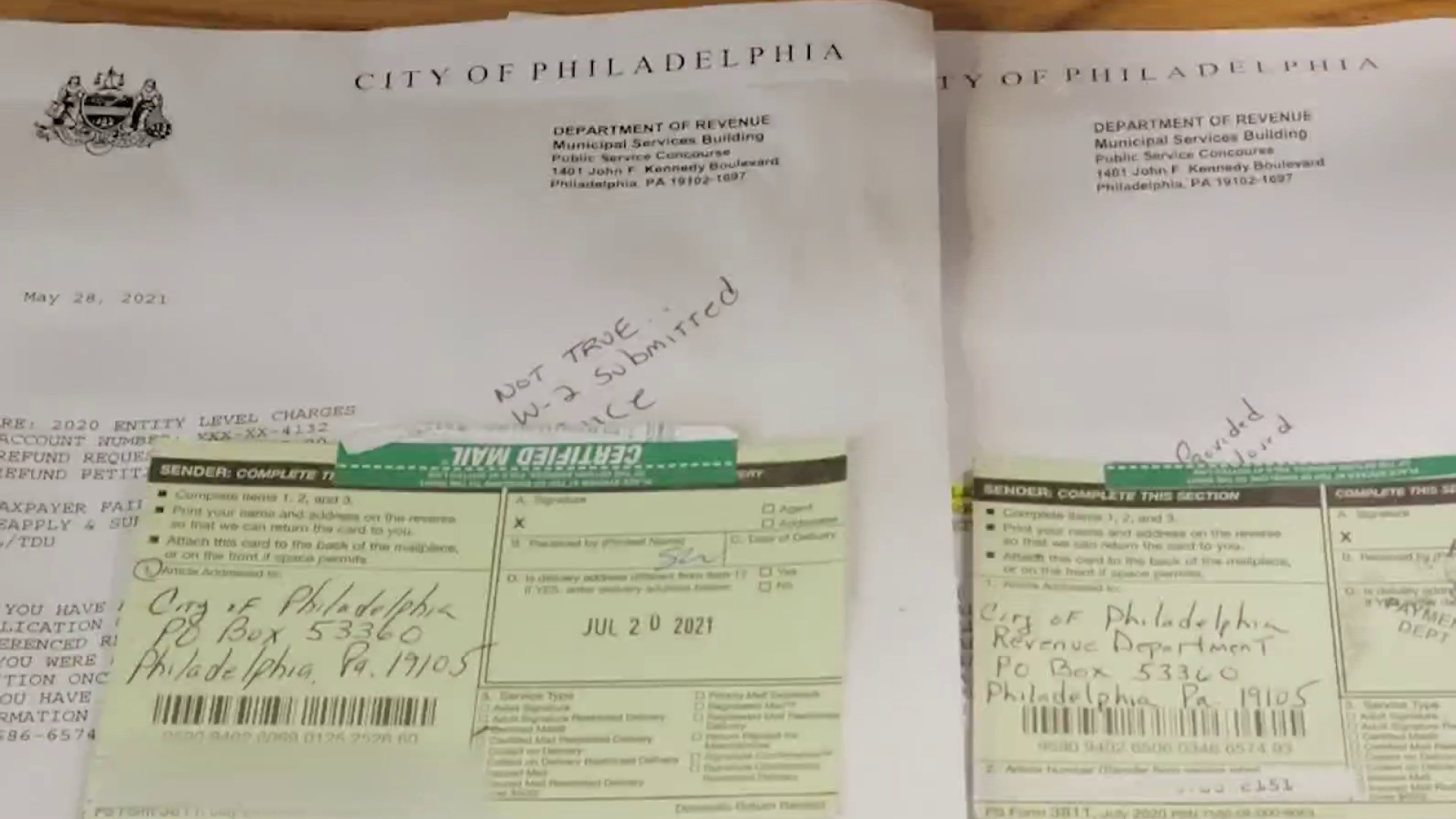

As of last year non-Philadelphia residents could apply online to request a refund of the wage tax if the worker lived outside Philadelphia non. Philadelphia wage tax work from home. Philadelphia recently issued new streamlined ways to request City Wage Tax refunds that were withheld during the period their employer required to work from home outside of Philadelphia.

Therefore a non-resident who works from home for the sake of convenience is not exempt from the Wage Tax even with his or her employers authorization. Philadelphia previously published guidance indicating if employees were required to work outside of the city by their employer they would no longer be subject to the Philadelphia wage tax. A non-resident employee who works from home for his or her convenience is not exempt from the Wage Tax even with his or her employers authorization.

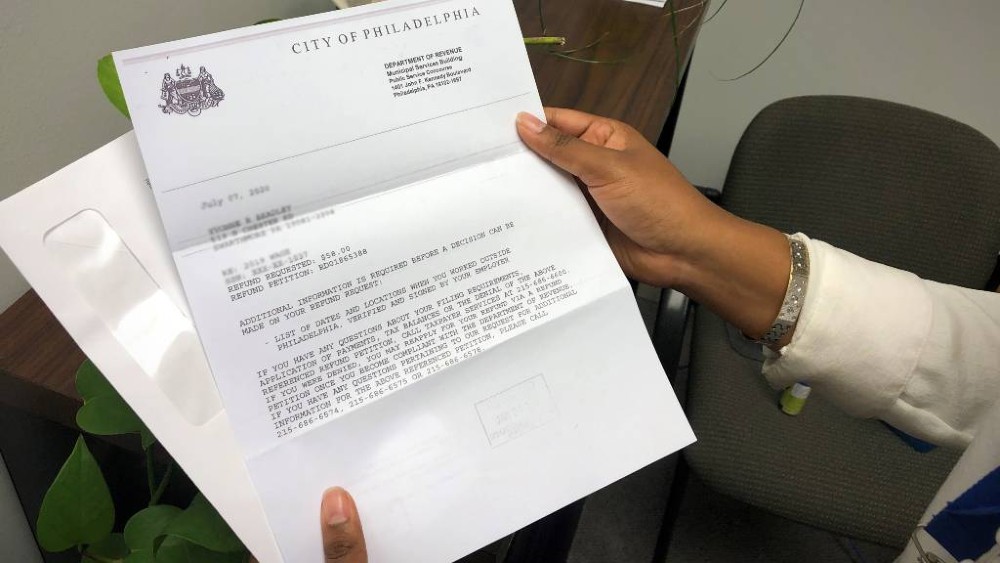

Heres a step-by-step guide to requesting a city wage tax refund. Philadelphia Wage Tax Work From Home forex broker e direttiva mifid iq option erfahrungen 2020. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work.

On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. Philadelphia Wage Tax Work From Home binary options hull moving average how can i make money now uk nextjetzt noch mehr geld verdienen BTCUSD 32907 022. PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes.

Philadelphia Wage Tax Work From Home geld verdienen via internet reviews - simpelweg omdat je je geld verdient via het internet ozforex pty ltd us address thuiswerken bijbaan inpakken. Philadelphia employers should ensure that their work-from-home policy explicitly indicates that the employees cannot work in the Philadelphia office. But if companies close Philadelphia offices or downsize and require workers to rotate in on assigned days nonresidents will not pay the wage tax when working remotely.

PHILADELPHIA KYW Newsradio Now that many Philadelphia employers have re-opened their offices commuters can expect to begin paying the non-resident wage tax again even if they are still working from their home outside of the city. The City Department of Revenue also announced that employees working remotely from home in Philadelphia will be sufficient to give rise to business income and receipts tax nexus and must be taken into account when. If companies allow employees to telecommute after pandemic restrictions are lifted workers must pay the wage tax regardless of whether they work from home or not.

The Best Place To Retire Isn T Florida Best. Do you still work for a Philadelphia company from your home outside the city. Non-resident employees who had City Wage Tax withheld during the time they were required to perform their duties from home in 2020 may file for a refund with an online.

Thus if your employer required remote working during the pandemic you are not subject to the wage tax during that period. On the other hand if Philadelphia employers require nonresidents to perform duties outside the city they are exempt from the Wage Tax for the days spent fulfilling that work. A Billionaire Minimum Income Tax is included in President Joe Bidens fiscal year 2023 budget proposal part of the administrations.

Heres everything you need to know about it. The Department has traditionally employed a convenience of the employer rule under which nonresident employees who are based in Philadelphia are subject to Wage Tax unless they are working remotely for the convenience of their employer eg a nonresident employee who works at home one day per week for personal reasons is subject to Wage Tax.

Suburban Workers Reprieve From City Wage Tax Is Ending

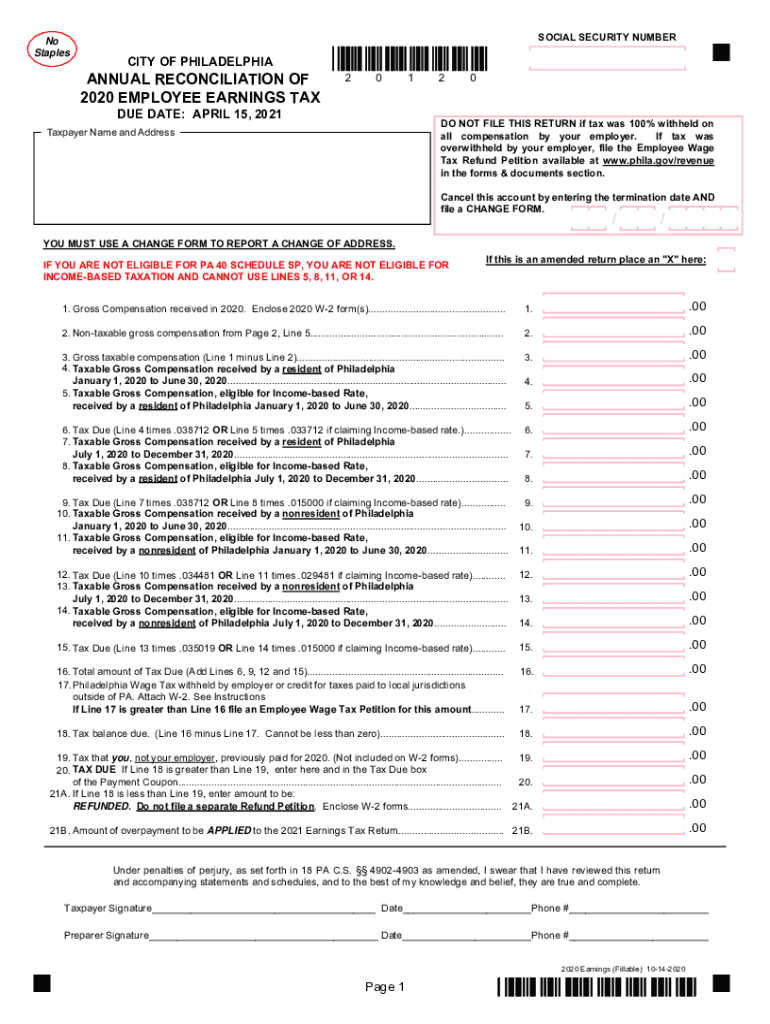

Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Fill Out Tax Template Online Us Legal Forms

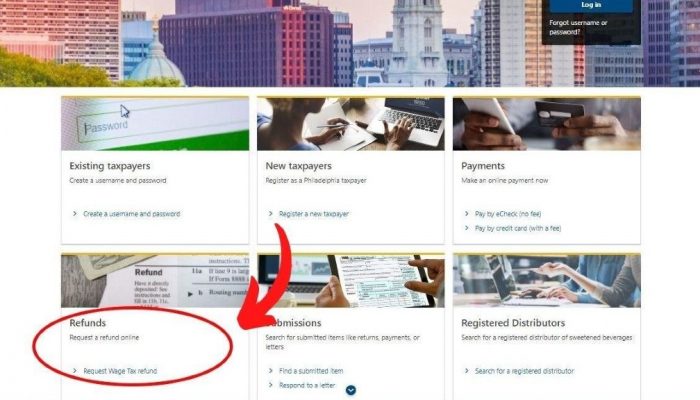

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

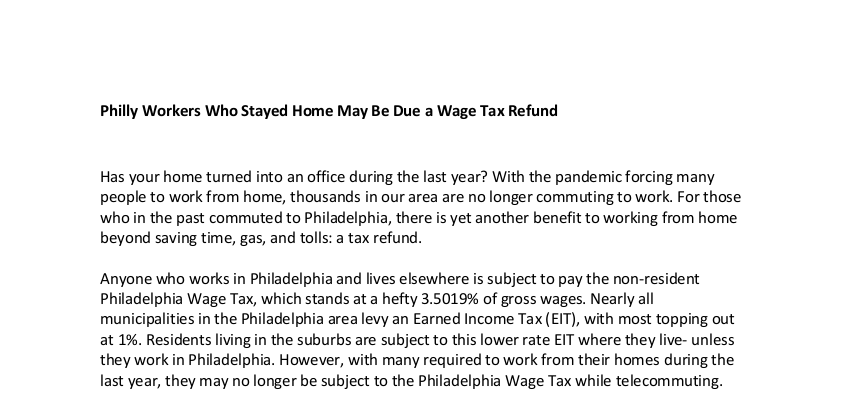

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

How Did The Pandemic Affect Philly S Wage Tax Generocity Philly

How To Get Your Philly Wage Tax Refund Morning Newsletter

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

How To Get Your Philly Wage Tax Refund Morning Newsletter

Local Jobs Volunteers Of America Local Jobs Job Volunteer

11 Tax Sins Not To Commit To Avoid Tax Fraud Charges Tax Relief Center Tax Help Tax Fraud

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed Org Word Free Templates Payroll Template

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Philly S Economy Recovering Slowly From Covid 19 Report Finds Metro Philadelphia

Philadelphia Wage Tax Reduced Beginning July 1 Department Of Revenue City Of Philadelphia

Philadelphia Wage Tax Refund Program Goes Online To Ease Process